Ever found yourself scratching your head at the end of a financial year, wondering how those business lunches and office shindigs have bumped up your tax bill? Well, you’re not alone.

Fringe Benefits Tax, or FBT, often catches Aussie business owners by surprise, especially when it comes to entertainment expenses. You need to know what counts as entertainment and how it can impact your tax obligations.

In this blog post, let’s dig into FBT and learn how you can effectively manage these expenses to keep surprises at bay.

So, What’s “Entertainment” in Business?

By the book, the Australian Taxation Office (ATO) tags entertainment as activities or perks involving food, drink, or recreation that are provided by employers to their employees or their associates. Think along the lines of business lunches, celebratory drinks, office parties, and even tickets to sporting or cultural events. If it’s fun, it’s likely entertainment.

The classification of these expenses also dives into the context and conditions under which they’re provided. For instance, a casual drink at the office might not be entertainment, but an all-out bash with cocktails at a fancy venue? Definitely entertainment.

The key factors that swing the decision include:

● Why it’s provided: Is it for general enjoyment at a social gathering, or is it essential for the employees to perform their duties?

● What is provided: Simple tea and biscuits or a full-on gourmet meal?

● When it’s provided: During work hours or at a separate time?

● Where it’s provided: On business premises or somewhere else like a restaurant or function hall?

The nuances of these questions determine if an expense falls into the entertainment category and thus influences its tax implications, particularly concerning FBT. Regular business expenses that are plainly for operational purposes (like providing coffee or lunch during a working meeting on-site) generally steer clear of the entertainment tag.

So, What is FBT?

Essentially, FBT is a tax employers pay on certain benefits they provide to their employees or their employees’ families and other associates – beyond the usual salary or wages. These benefits might include company cars for private use, free gym memberships, or entertainment perks like tickets to a game or a show.

FBT is calculated separately from income tax and is based on the taxable value of the various fringe benefits provided. The ATO requires employers to ‘gross-up‘ these benefits. This means adjusting the value of the benefits to reflect the gross salary employees would have had to earn to buy the benefits themselves.

Employers must also register for FBT, calculate how much is due, and ensure this is reported and paid annually to the ATO.

FBT Concessions and Exceptions Explained

FBT can be a bit confusing, but there are a bunch of exemptions and concessions that can significantly reduce how much you have to fork over. Here’s a quick rundown to keep without diving to deep into the weeds:

● Minor Benefits Exemption: If the value of a benefit is less than $300 and it’s provided infrequently, it won’t attract FBT. This can cover things like occasional staff lunches or small birthday gifts.

● Work-related Items: Items primarily used for work, like laptops, mobile phones, and protective clothing, are usually FBT exempt. There’s a catch though: it’s generally limited to one item per category per employee each FBT year unless it’s a replacement item.

● Emergency Assistance: Benefits provided for emergency relief, like first aid training or providing flu vaccinations, are exempt from FBT.

● Taxi Travel: Costs of taxi travel that begins or ends at your employee’s place of work or due to sickness are exempt.

● Tools of Trade and Electronic Devices: If tools or electronic devices are primarily for work use, they’re exempt. This even includes multiple devices in the same FBT year if your business qualifies as a small business under ATO rules.

● FBT Exempt Organisations: Certain not-for-profit organizations, like public benevolent institutions and health promotion charities, have higher FBT exemption caps. For instance, public benevolent institutions have a $30,000 cap, while hospitals and ambulance services have a $17,000 cap.

Understanding these can help you navigate FBT more effectively and possibly save a fair bit in tax.

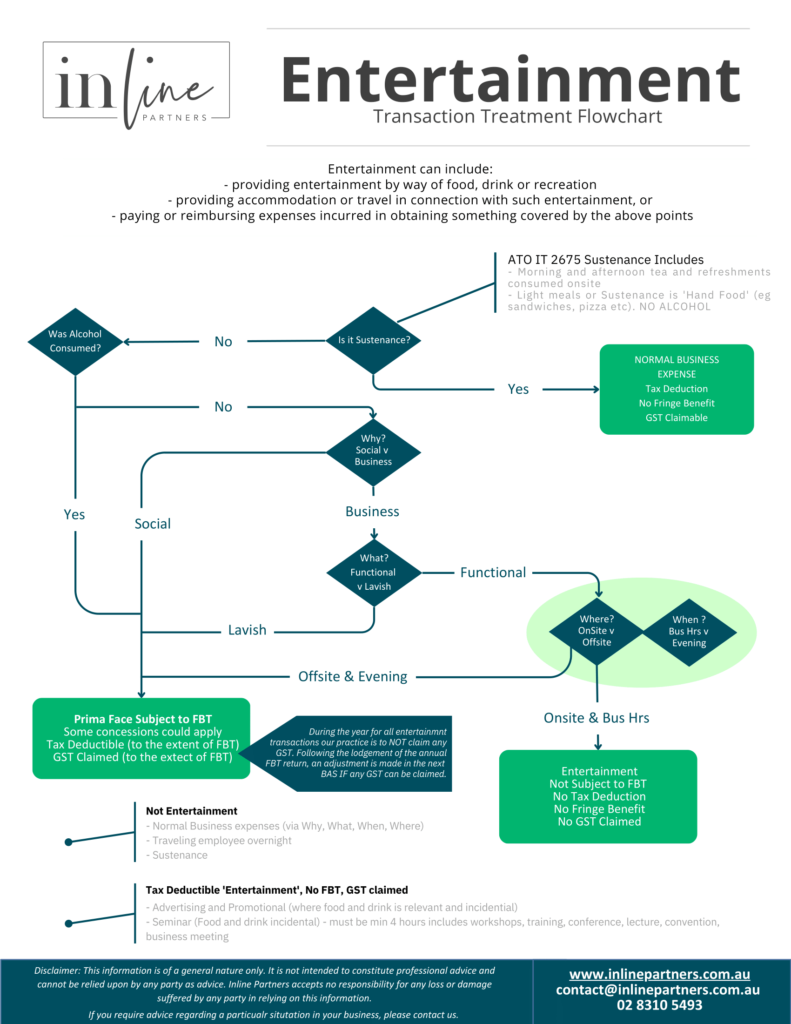

Entertainment Decision Flowchart

Here’s a flowchart we’ve created to help simplify deciding whether or not an expense falls under the “entertainment” umbrella:

With just a few decision points such as whether alcohol was involved, the event’s purpose (social vs. business), and the nature of the expense (functional vs. lavish), it becomes easier to figure out how these expenses will be treated come tax time.

If you want to see it in action, imagine you’re planning two different events. For the morning staff tea held onsite without alcohol during business hours, the flowchart would tell you that this is a normal business expense — not subject to FBT, fully tax-deductible, and GST claimable.

Contrast that with a client dinner held offsite in the evening where alcohol is served, and you’ll see that one will be categorized as an entertainment expense. That means it likely attracts FBT, isn’t tax-deductible, and you can’t claim GST.

Feel free to steal this flowchart. It’s designed to be a practical tool for businesses to use right from the planning stage of any corporate event or entertainment so you can easily manage expenses.

Tips and Tricks for Managing Entertainment Expenses

So, what strategies can you use to manage entertainment expenses and keep FBT low? Here are a few tips and tricks:

● Know the Deductions: Be clear about what is considered entertainment versus a staff amenity. Generally, events like staff parties or business lunches are entertainment and have different tax implications.

● Use the Right Methods: Adopt practical methods like the Actual, 50/50 Split, or 12 Week Register to accurately record and report entertainment expenses, which can help in maximising deductions and managing GST claims effectively.

● Plan with Tax in Mind: When organizing entertainment, consider how it will be perceived for FBT purposes. Keeping events simple and primarily for business purposes can help reduce tax liabilities.

● Keep Good Records: Maintain detailed records of all entertainment expenses, including the nature and purpose of the event, to substantiate claims and simplify tax filings.

Of course, we understand all of this is challenging to wrap your head around. If you’re still struggling or just need a bit of guidance on how to put all this info into action, don’t stress — we’re just a call or click away.

Drop us a line if you’ve got any questions or need a hand getting started. We’re here to help make sure your business is as tax-savvy as can be!